and selecting the appropriate option.

and selecting the appropriate option.

The following configurations will determine what information will be reported on the Remittance Statement, how it will be presented, what additional reports will be included and what transactions to include in the remittance.

For most

settings, you will make a selections for the following configurations

by clicking the  and selecting the appropriate option.

and selecting the appropriate option.

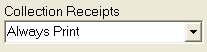

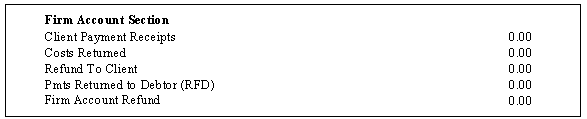

This section include a total of debtor payments and returned checks received by the law firm, received by the receiving attorney and received by the client that have been released during this remittance period. (The remittance period is time between last finalized remittance and the process thru date for this remittance.) It will also include any over-payments that have been returned to the debtor or adjusted off the debtor's account during this remittance period.

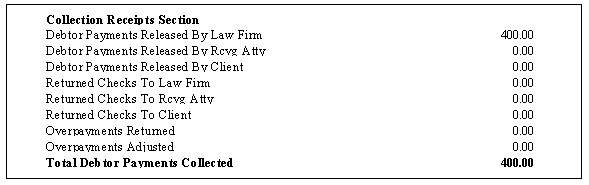

This section includes a total a breakdown of how much principal, interest, fees (court awarded), costs, other and over-payments were paid in the payments to be released in this remittance period.

This section includes a detailed accounting of collection fees on the debtor payments release this remittance period, the client and the receiving attorney, both contingent and non-contingent suit fees, flat suit fees and credits from the firm and trust accounts.

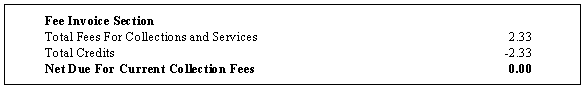

This section includes a listing of the Fee Invoice and any Credits the Remittance will be applying towards the invoice.

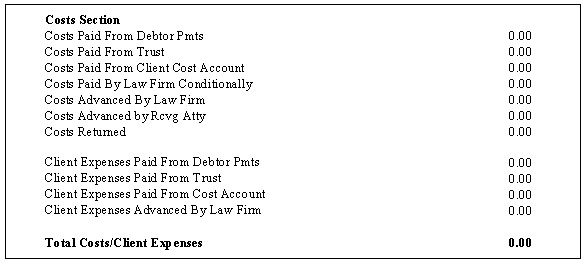

This section includes a detailed accounting of costs and cex transactions posted and recovered during this remittance period.

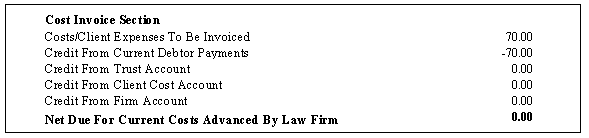

This section includes any costs and cex transactions to be invoiced to the client for this remittance subtracted by any credits applied during the remittance period or during the remittance process.

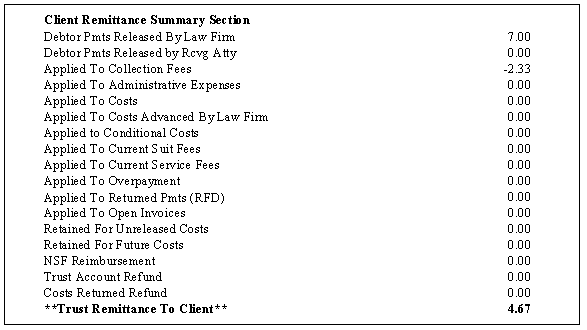

This section includes debtor payments released during the remittance and any allocations of these funds to costs, fee or other transactions for a total of the funds to be release to the client in this remittance period.

![]()

This section includes a summary of all fees and costs to be invoiced, any open invoices and any credits that have been applied to the invoices this remittance period.

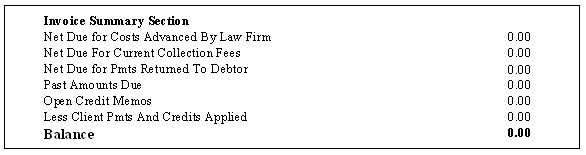

This section includes a summary of transactions that have occurred in the remittance period for the account with a balance summary.

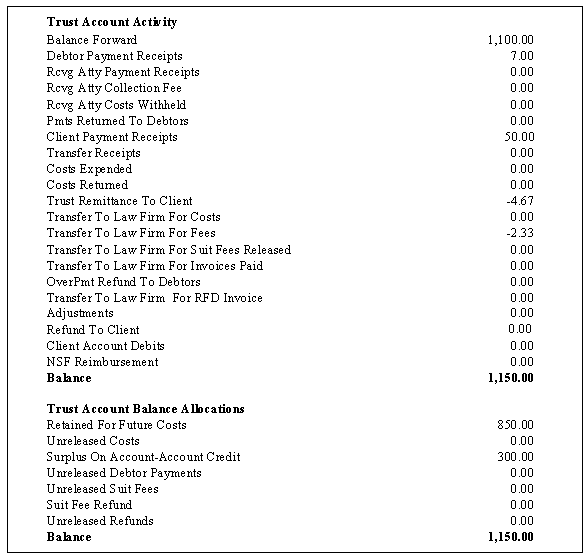

This section includes a summary of transactions that have occurred in the remittance period for the Client Cost Account with a balance summary. This section should be set to never print or print only if activity if you are not using a Client Cost Account.

This section includes a summary of transactions that have occurred in the remittance period for the account with a balance summary.

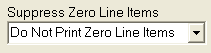

This will allow you to not print line items

that have a total of zero to reduce the size of the remittance statement

report. You

may choose to print all items by clicking the  button and

selecting Print Zero Line Items.

button and

selecting Print Zero Line Items.

This configuration allows you to have a page break between the last summary section of the Remittance Statement and the Trust Account Activity section. Chose this option if you do not want your client to receive the Trust Account information but would like to print this for your firm records.

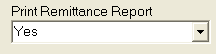

You can select to Print a Remittance Report. This report lists each account that have had payments or cost expended during the remittance period. The remittance report can be configured to print additional fields.

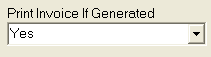

You can select to Print the Invoices if the Remittance Process generates an invoice.

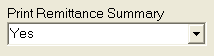

You can select to Print a Remittance Summary along with this Remittance.

You can select to Print the Remittance Recap Report along with this Remittance.

This option is used when printing more than one client remittance at a time. You can select to order the Remittance by Client Name or Id.

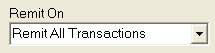

You may select to Remit All Transactions (the typical remittance setting), Exclude Direct Payments (remit only payments paid to the Firm), Remit Direct Payments Only.

![]()

You can select to list the Reference Number or Network Number on the Cost Detail Report. The Cost Detail Report must be selected to be printed in the Advanced Options.

Hint: It is recommended that the user keep the system defaults for the first preview remittance and then change to configurations to fit their needs.

Once the

configurations have been set, users may save these selections by clicking

the ![]() button. Defaults

may be saved per client, client groups or all clients.

button. Defaults

may be saved per client, client groups or all clients.

Note: If savings settings for a single client, all clients, client group or client set, the settings will only be used if choosing that exact client, client group or client set. If doing a remittance for All Clients, the settings set at the single client level will not be respected.